The best way to calculate your return is to use the Excel XIRR function (also available with other spreadsheets and financial calculators). Estimate the future value of retirement savings based on the interest rate. Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Our planners have helped hundreds of people retire and they've seen about every challenge and outcome. While calculators are helpful for making some decisions on your own, an experienced retirement planner is well-versed in predicting if you're on the right retirement-savings track. In 2022, 401 (k) contribution limits for individuals are 20,500, or 27,000 if you’re 50 or. This can make it a bit tricky to calculate the fringe benefit rate. For 2021, your individual 401 (k) contribution limit is 19,500, or 26,000 if you’re age 50 or older. The benefits will vary depending on the role and position each employee holds.

Figure Out The Value Of Each Employee's Fringe Benefits Package.

This can help you calculate the total cost of the fringe benefits and figure out whether it works with your budget.

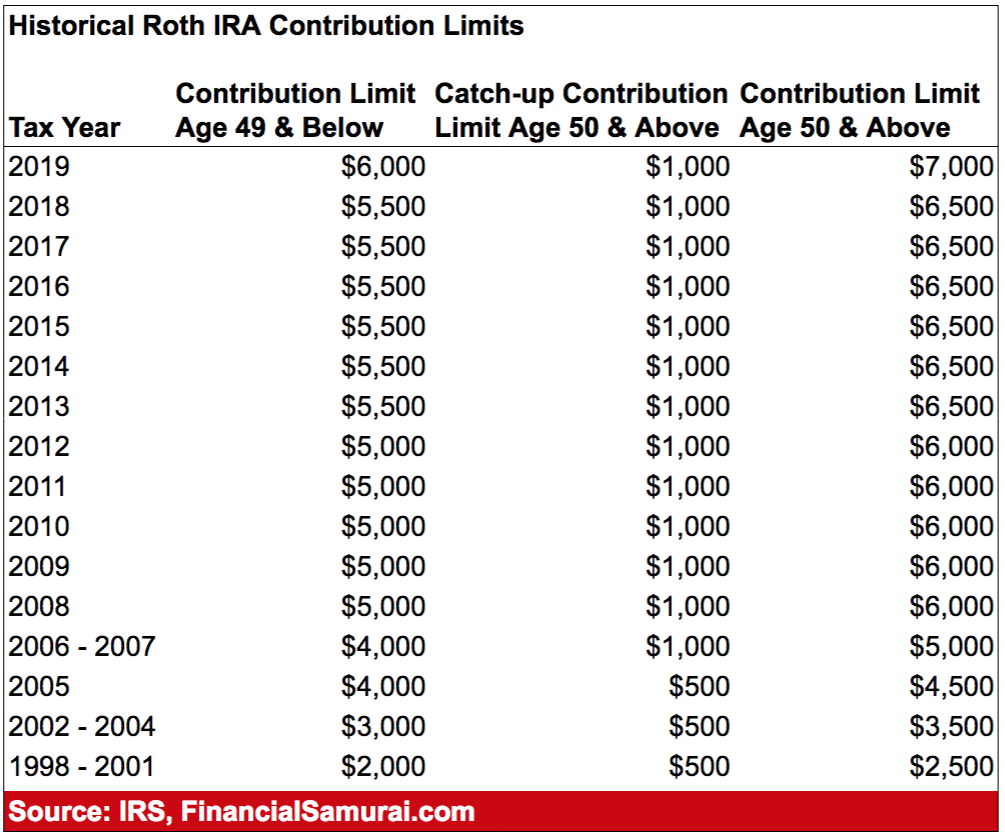

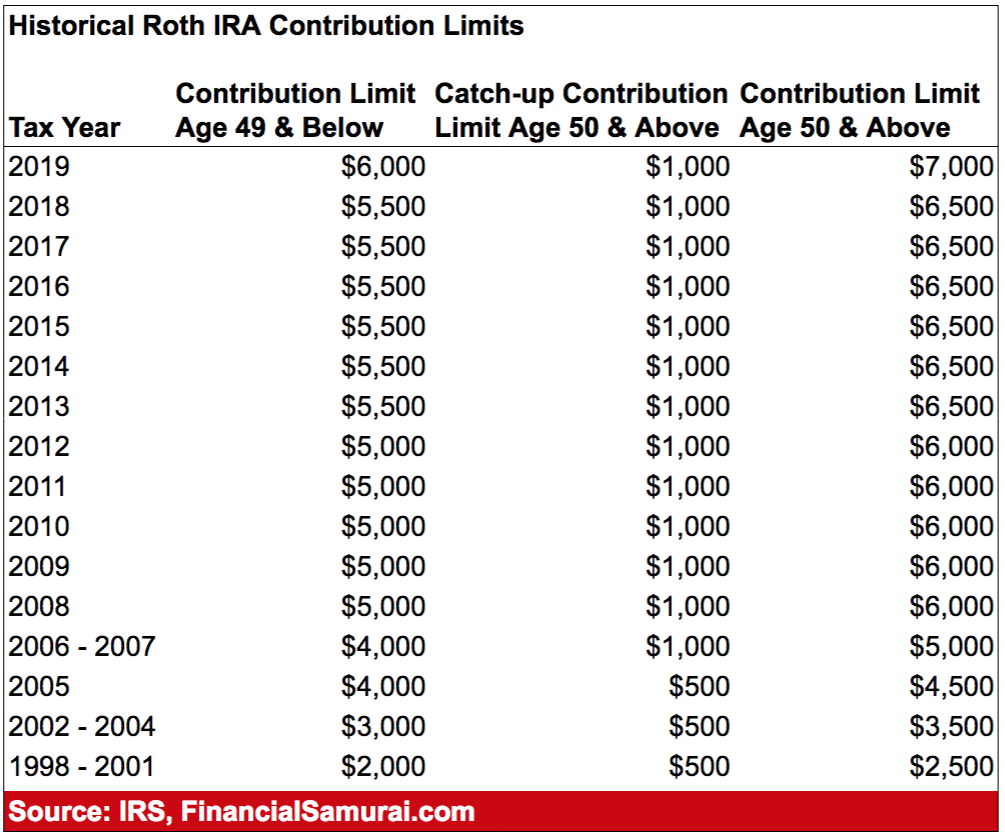

Let’s go back to the 401(k) calculator to look at that same example-you make $100,000 and contribute $6,000 annually to your savings-but without any employer matching. Even without matching, the 401(k) can still make financial sense because of its tax benefits.

That extra $6,000 basically makes the calculation a no-brainer. Meanwhile, the combined employer and employee contribution limit rises by 1,000 to 58,000. 401k Front Loading Max Contribution Calculator. The maximum 401 (k) contribution limit for 2021 is 19,500, the same from 2020. The 2022 defined contribution plan annual contribution limit. Those who are 50+ can deposit up to 26,000, with 6,500 of that as catch-up contributions, according to the IRS. For me this was always a headache and was usually more of an educated guess than a reliable calculation. 401(k), 403(b), 457 Plans The 2022 elective deferral limit will increase to 20,500 from 19,500. Find: Retirement 2022: IRS Announces New COLA Guidance, 401(k) and IRA Income Limit Increases Workers under the age of 50 can contribute a total of 19,5. Max 401k contribution 2021 how to#

Ck3 cultural acceptance war amass crossword clue how to report a noisy car uk nordvpn on mx linux unity animation clip add event svg color tri rail schedule northbound weekend ibis condo tamarindo for sale ham on sale this week near me The problem in attempting to front load and max out the 401k for the year is trying to calculate exactly what the contributions should be for each month.

0 kommentar(er)

0 kommentar(er)